Buying a property in England: How does it work?

You may already have bought several properties and think that there is no reason for the process to be different in the United Kingdom? Well, think again: rules in the United Kingdom are specific and buying properties in England is not easy.

Victorian House Parsons Green

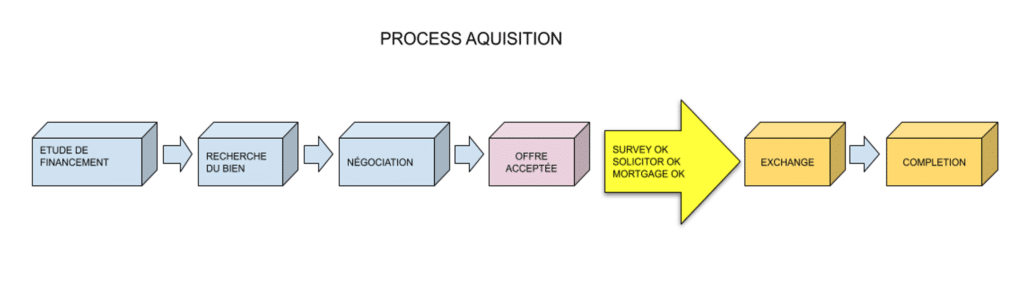

The main difference is that here, the buyer and the seller are not involved in the transaction until very late in the process, till the time comes to exchange contracts. Before that, the technical survey on the condition of the property and legal searches will have to have been completed. Both parties can therefore withdraw at any time before the exchange without penalties. Only the costs already incurred in the preparation of the transaction will be lost, including the surveyor fees for the technical survey and conveyancing solicitor fees for the legal search.

House designed by an architect Richmond

The first thing to do when planning to buy a property in the UK, should it be your home or a buy to let investment, is to set your budget. If you need a mortgage to supplement your deposit or to benefit from a significant leverage effect due to the very low current interest rates you will have to approach the banks.

We recommend you go through a mortgage advisor who will be able to find you the best products available on the market. You will then be able to assess your maximum budget. Note, at this stage you will only have an agreement in principle based on the general information provided. It’s only after your offer on a property has been accepted, that your application will be processed with the supporting documents you provide. You will then receive an offer from the banks. Therefore it is essential to have a reputable advisor to avoid unpleasant last minute surprises.

You will then have to start your search for a property. London is a big city and it’s easy to quickly feel overwhelmed by the multitude of properties available and estate agents bombarding you with emails and phone calls. We therefore recommend that you analyse the market in terms of price and area in order to refine your search. You will then be in a better position to consult local estate agents and use good web sites like Rightmove or Zoopla. Beware though that these web sites are never completely up to date and many properties, usually the best ones, are either not listed or even sold before being advertised! The next step will be to contact the estate agents and organize visits. It quickly takes a lot of time and energy. Don’t expect estate agents to give you in-depth information – they are protecting the interests of the seller after all. We, at French Touch Properties support only you, the buyer, at each and every stage of your project.

When you have found your dream property, it is time to make an offer followed by the negotiation. Negotiating is difficult and often stressful: the agents will not always tell the truth. They will, for example, tell you about other interested buyers and it is impossible to know if they are real or made up. It is after all in the agent’s interest to see you raising your offer. Tip: avoid showing the agent too much enthusiasm or desperation for the property.

Notting Hill

Once your offer has been accepted, it’s great but things start to become more complicated. The estate agent will ask you for a number of documents including proof of cash funds or the mortgage. They will get in touch with your solicitor who will work with the seller’s solicitor. A survey will have to be done. The surveyor will write a technical report on the condition of the property to make sure they are no major problems and to give an estimate of the costs to be expected for any maintenance or renovation work. This report is not mandatory but highly recommended especially if you are buying an older property.

Surveyors’ reports are often very comprehensive and overwhelming. It may be difficult to distinguish between what can be considered normal and acceptable, and what may need to be addressed or in any case assessed further. French Touch Properties will help you draw the right conclusion and solve any possible concerns.

It will take at least 6 weeks for the solicitor to collect all the information and report to you. It would be unusual not to find any technical or legal issues coming up in this phase. The involvement of the solicitor will often be limited to the legalities. He is a trained lawyer and will rarely have the skills or the will to help you find solutions. French Touch Properties will work with you to analyse the solicitor’s report and related documents. We will then work with the solicitor and surveyor to resolve any outstanding issues.

Once you are satisfied with the survey and the solicitor’s report, it is time to proceed to the exchange stage. Your solicitor will ask you for a deposit of 10% of the purchase price, to reserve the property. You are now committed and you will lose this deposit if you were to withdraw from the transaction. On the day of the exchange, you will have to agree with the seller the date of completion, which is the date when you will finalize the transaction and become the new owner. This period can be very short if the property is vacant and you are a cash buyer, for example, 24 hours or longer if the property is already rented out as 2 months’ notice are required for the tenant, or if the seller is in a chain and is looking for a property to buy.

Finally, it is completion day. You will be paying the remaining 90% of the purchase price as well as the legal fees and the stamp duty. You will collect the keys from the estate agent who sold you the property and you are now in your home. Congratulations!

It may sound simple on paper, but buying a property, though exciting, is often laborious, energy intensive, stressful and fraught with pitfalls. It is an important project with large sums at stake. Can you afford not to get help?

French Touch offers you support from beginning to end in order to define your budget and your objectives, identify the best properties, negotiate and manage the entire acquisition process with you. We take your project to heart, and we can reassure you and answer any questions at every step. We will probably end up saving you a lot of time, money, stress and energy.

Call us – we will take care of everything !

Jardin Partagé à Belsize Park